Trusted by:

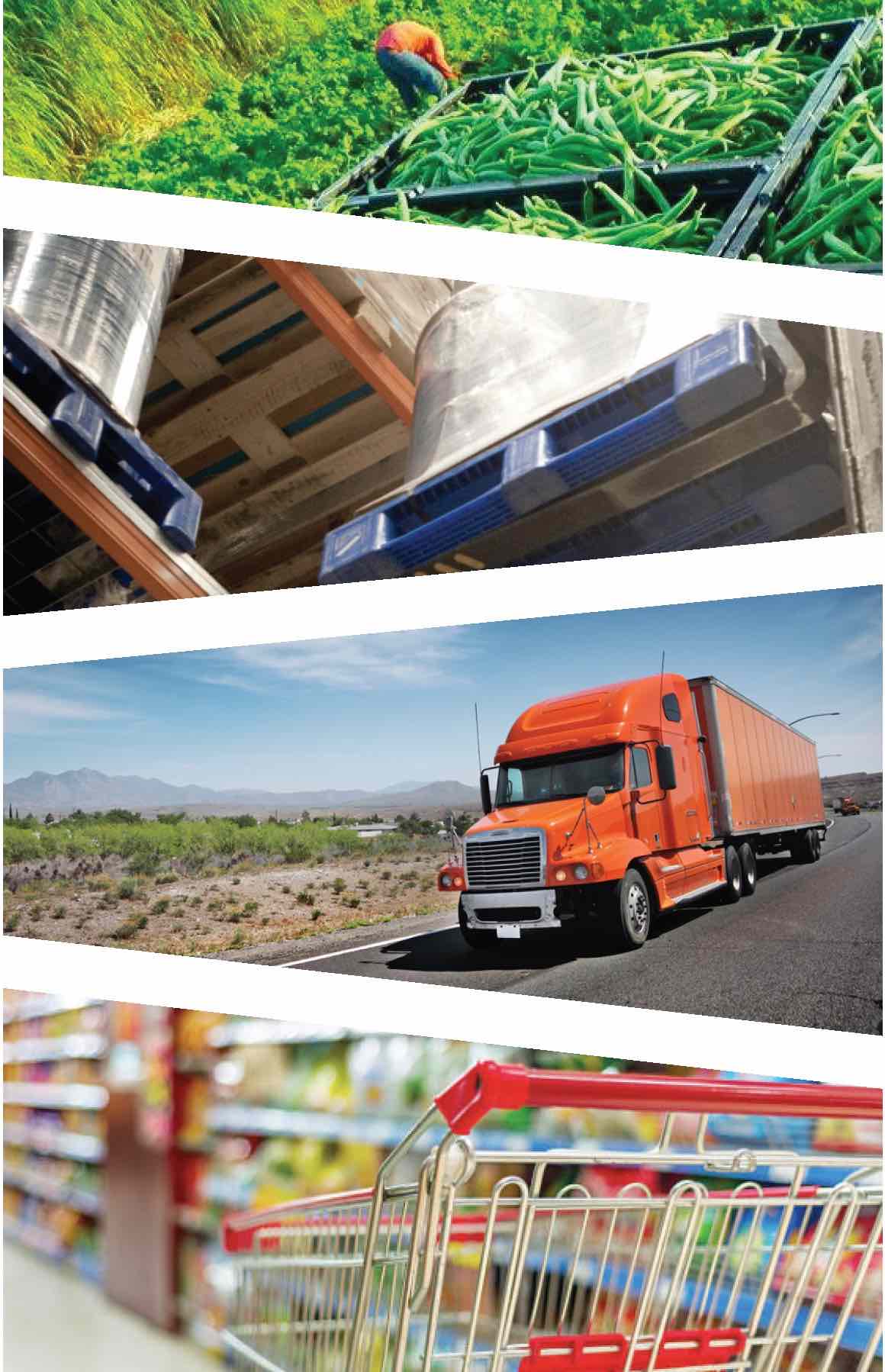

See the impact everywhere in your supply chain.

Pooled reusables with responsive service.

Is packaging slowing you down? Tosca reusables are always ready to move. Get access to industry-leading plastic crates, bulk containers and more with no capital outlay.

A flexible global network that’s wherever you are

Tosca is a leading pooler of plastic crates in North America and plastic pallets in Europe. Our massive footprint of wash, service and repair centers delivers the perfect combination of size, resources and flexibility.

Get in touch with a Tosca expert.

Let’s explore how we can help you solve your most prevailing challenges and walk through how reusables can bring efficiency, sustainability, and savings to your supply chain.”